Japan's Overseas Investment Surge: A Historic Milestone

Record-Breaking Asset Growth

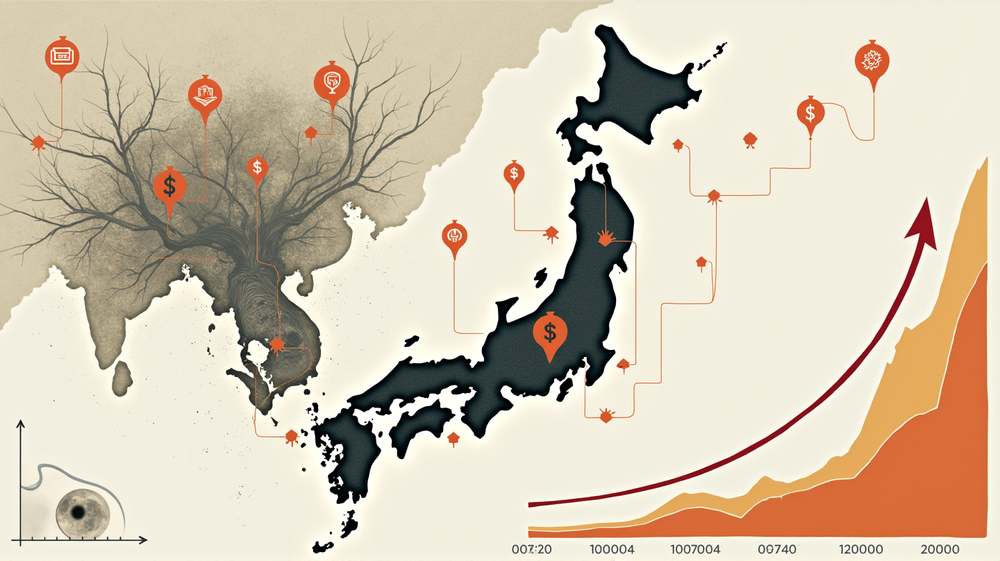

Japan’s net external assets have reached an unprecedented ¥533.1 trillion in 2024, marking a 12.9% increase from the preceding year. This reflects the seven-year growth trajectory fueled by a weakening yen and a robust zeal for international mergers and acquisitions. The rise was chiefly driven by the yen’s depreciation, which inflated the yen-based value of Japan’s existing global assets. According to The Economic Times, this momentum in asset accumulation underscores Japan’s strategic inclinations for expanding its overseas financial footprint.

Economical Shifts in Global Rankings

Despite this historic achievement, Japan has seen a reshuffling in its global financial credit status. For the first time in 34 years, Japan was dethroned as the world’s leading creditor by Germany, which now boasts net external assets of ¥569.7 trillion, while China secures the third spot with ¥516.3 trillion. These changes spotlight the dynamic shifts in global economic standings and provoke speculation on Japan’s future strategies in regaining its pivotal position.

The Currency Influence

A focal force behind this financial surge is the currency fluctuations, particularly the appreciation of the US dollar and the euro against the yen. The dollar’s 11.7% and the euro’s 5% appreciation effectively boosted the yen-denominated value of overseas assets, illustrating the compounded effect of currency dynamics on Japan’s investment landscape.

Balancing Assets and Liabilities

As of the end of 2024, Japan’s gross external assets totaled ¥1,659 trillion, revealing a significant increase from the previous year. Conversely, external liabilities surged to ¥1,126 trillion, marking Japan’s increasing international economic interplay and its growing global financial engagements.

Current Account Status

The Ministry of Finance’s updated figures reveal a current account surplus of ¥29.4 trillion for 2024, surpassing initial estimates. The current account’s positive trajectory provides insights into the nation’s robust fiscal health and its enduring operational efficacy on the global stage.

Concluding Insights

Japan’s historic peak in external assets encapsulates its enduring influence in global financial realms, driven by acute currency valuation and strategic international investments. Yet, the shift in creditor status to Germany invites contemplation on Japan’s adaptability and foresight in navigating its future economic pathways.