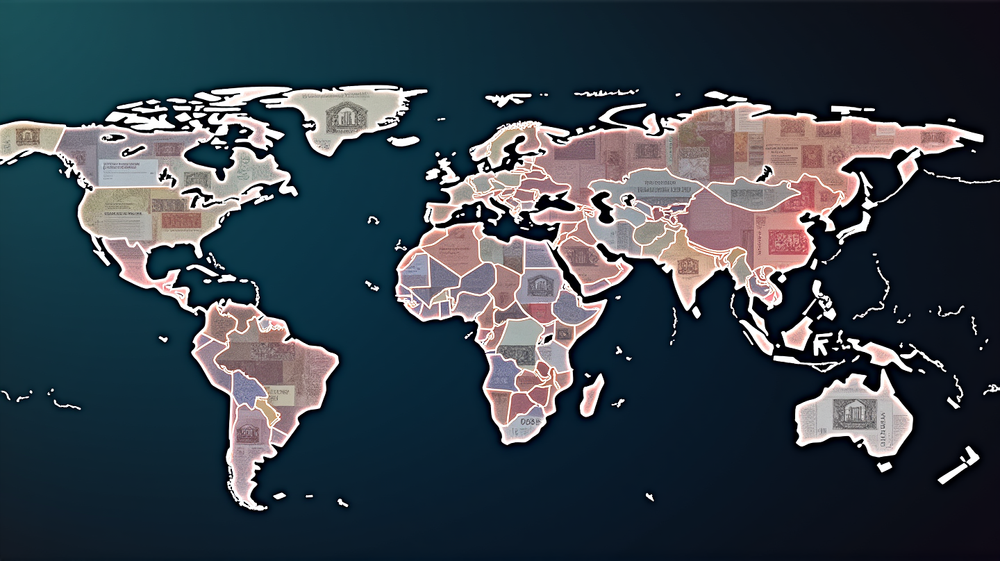

Unlocking the Potential of Your Portfolio: The Case for International Stocks

2025 has been a remarkable year in the world of finance, with global equities surpassing the performance of the U.S. stock market by a striking margin. After years of dominance by American stocks, this shift is a compelling reminder that diversifying your investments across geographies is not just desirable but essential. In a world where markets are increasingly interconnected, betting exclusively on domestic stocks can lead to a precarious concentration of risk.

A Global Shift in Investment Dynamics

In the first half of 2025, international equities outstripped U.S. stocks by approximately 10%. This performance has drawn attention to the necessity of geographic diversification. Bank of America’s June Global Fund Manager Survey revealed that more than half of professionals believe international stocks will dominate returns over the next five years. Such predictions highlight the potential pitfalls of “home bias,” a term coined by behavioral economists to describe investors’ habitual over-allocation to domestic stocks.

Rethinking Domestic Dominance

Historically, American portfolios have heavily favored domestic stocks, often to their detriment. A recent report from the Plan Sponsor Council of America disclosed that a typical investor holds a whopping 82% of their equity in U.S. stocks. This bias fails to capture the diverse opportunities offered by other markets, which can provide stability when America’s economic cycle falters. In contrast, international markets benefit from different economic conditions, exchange rates, and growth cycles.

Embracing Global Diversification

Global diversification can appear daunting, but it need not be. Investors can achieve international exposure without venturing into complex foreign markets. Options such as Ex-U.S. international index funds and country-specific ETFs serve as gateways to global diversification. These tools, including ADRs for individual foreign stocks like Nestlé or Samsung, allow seamless integration into any portfolio without the need for foreign brokerage accounts.

The Case for Broader Horizons

As we look forward, the prudent allocation of at least 20% of one’s portfolio to international stocks is a strategic move. This realignment ties your portfolio to the broader global economy, minimizing dependence on any singular national market. According to Investopedia, this diversification mitigates risks, introduces new opportunities for growth, and hedges against economic or political turmoil in specific regions.

Conclusion: Seizing the Momentum

In a rapidly evolving financial landscape, clinging solely to domestic investments appears increasingly short-sighted. By injecting international stocks into your portfolio, you’re not just diversifying for safety—you’re positioning yourself to capture returns wherever they appear. In 2025, international markets have demonstrated their rising stature, reminding us all that a broader investment horizon can indeed be a distinct advantage.